This AI generated chart depicts consistently rising dividends, along with a stock price that stairsteps its way up, depicting opportunity in the dips.

I’m Investing heavily in my best ideas. Not investment advice, do your own due diligence.

A compounder of a different sort.

Decisive Dividend is anything but boring and appears to be one of few serial acquirers available at a fair price – and with a long runway for compounding growth.

This business model flies under the radar. By using a 50–50 split of debt and equity for each new acquisition, and then distributing the profits via dividends – Decisive Dividend is a completely different kind of compounder.

A compounder where monthly DIVIDENDS can build and build and build – with each and EVERY new acquisition.

As an investor, I eagerly await new acquisition announcements, because each announcement means earnings per share will likely increase, and logically the stock price too. At the same time though, I hope the stock pulls back, providing an opportunity to accumulate more, but for less.

Targeting 25% profit growth per year

Management plans to boost yearly net profits by 25% via new acquisitions, much of which is dividended out, as per their model.

So It’s fun and quite possibly not a complete waste of time, to hypothesize where dividends will be in 15 or 20 years!

Thoughtful, prudent, ethical and shareholder-focused management is of course essential – and the board too. I think we have this, time will tell.

This is a very repeatable model since they are repeatedly buying small manufacturing businesses. There are many. Tons of these founders will seek a sale over the next years and decades and Decisive dividend will surely be in many of these conversations.

Purchasing new cash flows. On repeat.

It surprises me that many highly educated investors look at the new equity issuance and immediately look away, not realizing that new shares are issued only to buy NEW cash flows. And, if cash flows from newly acquired companies are immediately accretive as they have been, on a per share basis, then It’s ‘not really’ dillution folks.

Again, each acquisition is accretive on a free-cash-flow/share basis.

Hopefully they’ll get to 3, 4, 5 or 6 acquisitions every year, consistently. For Decisive this seems doable. McKinsey and Associates considers that companies with the capability of making multiple acquisitions per year would be called ‘programmatic serial acquirers’. The best sort.

You’ve got to turn over this rock to understand the model.

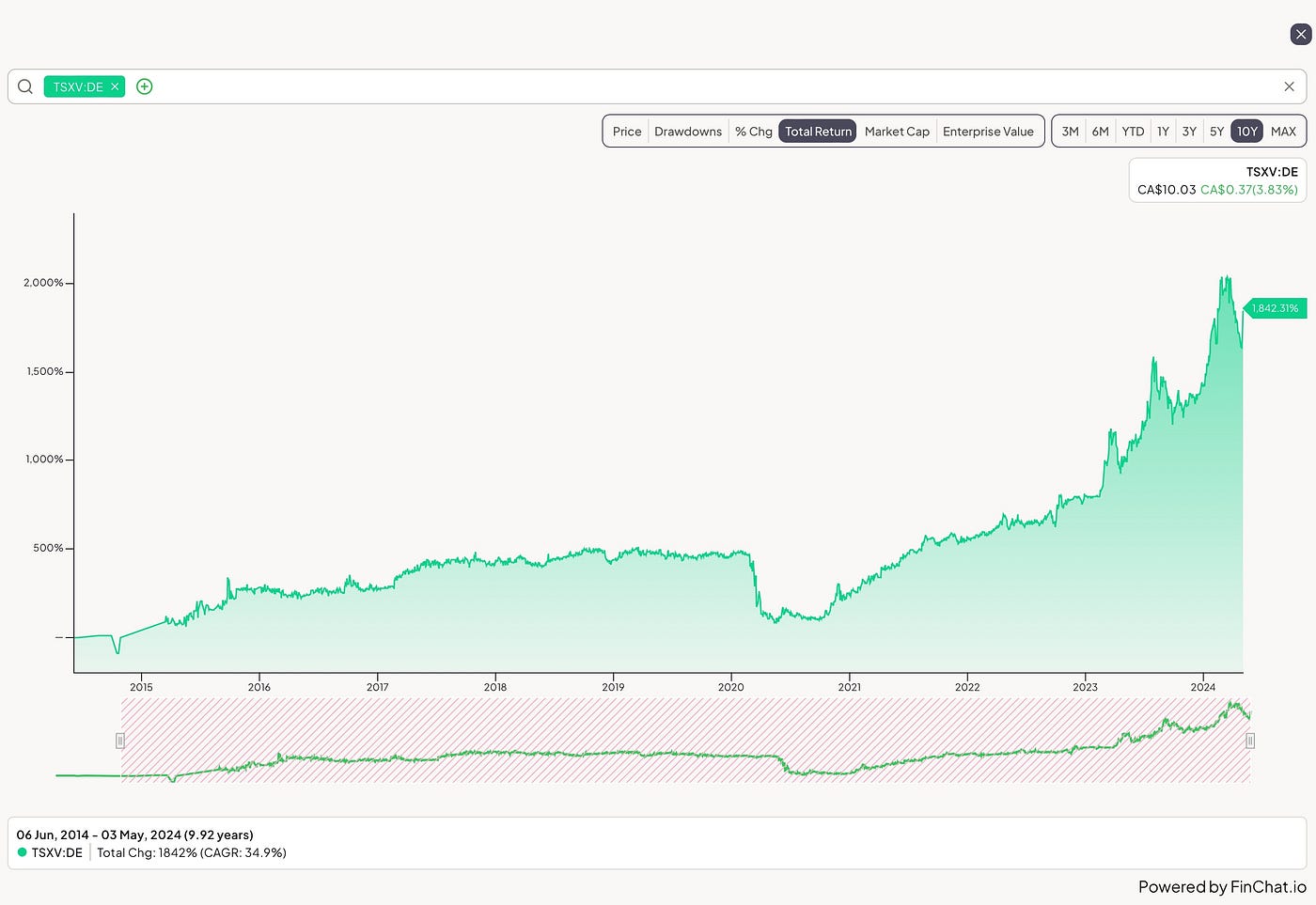

I consider Decisive Dividend to be a really smart serial acquirer with sheltered-risk, due to the monthly dividends, but with the same 5 year and 10 year CAGR potential, IMO, as other top serial acquirers the likes of TVK.TO, TOI.V, LMN.V or CSU.TO.

Cumulative annual growth rate (CAGR) is 34.9% over the past 10 years. This includes dividends. What’s not to like?

Paying dividends as a serial acquirer is unique and so very compelling, to those who know.

Paying dividends adds rigor to operations. These profits go directly into shareholders pockets, cannot be otherwise allocated to a potentially inferior organic growth opportunity and so removes some element of uncertainty.

Backed by a syndicate of large Canadian banks.

Decisive dividend currently has 107 million in debt lined up for new accretive buying. So the big Canadian Banks love them and they do REALLY-HEAVY due diligence. This is important, and very telling, as Canada’s big Banks are prudent low risk lenders.

Is a new equity raise on the horizon?

And remember Decisive Dividend typically wants to use a 50–50 mix of debt and equity. This means that they could do a new equity raise at any time, for new acquisitions.

New equity investors will only invest if they feel the valuation is fair. It is for this reason that we don’t want the stock price to ever get too overvalued. At sub 10, 11 or 12 bucks/share, I don’t think it is.

As with past raises, investors who really understand this model eagerly lineup and fully subscribe.

Management won’t raise more than what’s needed for current acquisitions. For example, if new acquisitions are sourced 6 or 12 months in the future, it may economically make sense to do another equity raise later as well, possibly at higher share prices.

Any dip in the share price as a result of new share equity, will likely be short-lived. New acquisition announcements are typically accompanied with details on the expected per share profit increase from the newly acquired cash streams. And then an increase in monthly dividends is also probable, depending on the size and number of acquisitions.

This is after all the business model. Dividends. Compounding dividends actually.

Reducing risk

Similar companies that don’t pay dividends may struggle to raise non-dillutive equity during down markets, always at the mercy of Mr. market’s sentiment.

Decisive dividend is different. They pay monthly dividends. In fact nearly all, less capex, profits are targeted to be dividended out monthly.

Investors respect and love this – during downturns especially. You don’t see this every day. It’s the opposite of a greedy’ish fee-based AUM private equity model (that rewards raising money, not raising profits and actually increasing value to shareholders) and the opposite of a model that doesn’t consider the opportunities of cycles.

Warren Buffet, the late Charlie Munger and the master of cycles himself – Howard Marks, would surely agree that the best deals are available during a downturn and so that’s when a serial acquirer like Decisive needs the capital – to make these most attractive buys. Many other buyers, like the non-dividend payors and the oodles of un-unique serial acquirers, will be on the sidelines.

Being fair to investors and shareholders.

Paying monthly dividends is generous to investors and shareholders. And investors reward the company by eagerly lining up to participate whenever new equity is issued. This business model seems right for ALL markets. Especially now that market participants are rational, making prudent investment decisions, actually valuing profits over near-sighted revenue growth and valuing operational excellence over reckless indulgence.

The exuberant times of so many serial acquirer wannabe’s raising easy money, are over.

I’m a buyer, an accumulator, a long-term owner

And for Decisive Dividend, I’m a buyer. Slowly building my position, holding for the VERY long term and I’ll happily watch my monthly DIVIDENDS compound. Those who turn away because of ie new shares being issued regularly or because dividends are boring can spectate from the sidelines.

Decisive Dividend is a different kind of compounder folks. These 20% pullbacks have happened a half a dozen times over the past 10 years. Such pullbacks have been opportunities.

Buying on weakness

The April 2024 Decisive Dividend move was short-lived, a 2 week pullback and on low volume. Weak hands that don’t understand the story will sell their shares at the first whiff of market concern.

And even when such concern has nothing to do with company-specific prospects. Such as, in my opinion, what just happened.

Long-term owners ignore or dollar-cost average through the market noise.

I don’t think we missed out on buying the dip. But markets could certainly dip again. And for long-term owners, dips should be welcomed. Considering the low volume it was difficult to add any shares in size anyway.

Slowly. Assuredly. Anticipating the dividends to compound grandly in time.

So it’s high-time again to be BOLD.

Victoria, BC based Don Wharton is the Executive Chairman of Sureswift Capital Inc, the SaaS serial acquirer that distributes profits monthly to investors.

Not investment advice. Do your own due diligence.