Constellation Software Inc. has one of the greatest roll-up strategies of our time, and its success in the aggregator space has inspired many serial acquirers to try to replicate that magic. What is Constellation’s recipe for success? Deploying capital in a perpetual stream of new acquisitions rather than reinvesting in organic growth for their acquired businesses. Yet some aggregators are still choosing to prioritize organic growth–inevitably resulting in underperformance–despite the abundance of data recommending otherwise.

An entrepreneur’s modus operandi is to be independent-minded and confident. Important qualities needed when building a company from the ground up, but which can also sometimes create a major blind spot. Ignoring the pitfalls of others, they barrel down the wrong track bolstered only by the deeply held belief that they can do it better. While the passion is commendable, our advice to is stop fighting the data and instead use it to your advantage.

Focusing on what’s proven to work sounds simple in theory. However, in practice, we’ve found it requires a rational, data-driven approach backed by discipline and the right processes to implement it effectively.

Growth by acquisition – through the lens of Constellation

Constellation is a clear example of how capital allocation decisions profoundly impact a company’s future trajectory and how carefully allocating cash flows toward new acquisitions is a viable and profitable business model. We’ve seen many entrepreneurs attempt to follow a similar strategy without fully understanding the critical dynamics of efficient compounding–resulting in poor capital allocation decisions, particularly regarding reinvestment of profits.

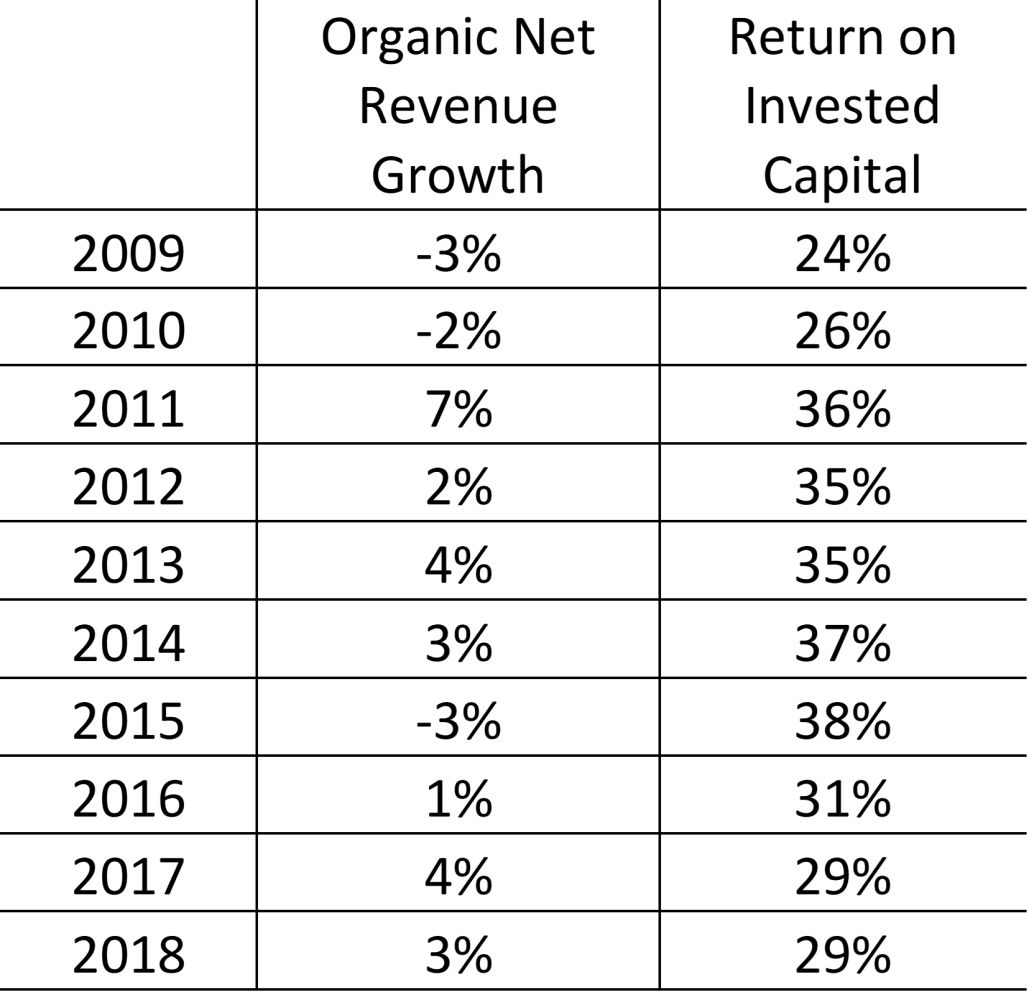

The data from Constellation’s hundreds of acquisitions shows minimal organic growth. Further demonstrating that small vertically focused SaaS companies rarely become moonshots and produce outsized returns from reinvesting profits into their growth initiatives. Instead, Constellation’s success has been purely driven by aggregating cash flows through investing profits in a perpetual stream of new acquisitions.

Constellation Software – Organic Net Revenue Growth and Return on Invested Capital (2009-2018)[i]

Constellation Software – Organic Net Revenue Growth and Return on Invested Capital (2009-2018)

Put simply, unless there is a superior reinvestment opportunity, profits should be perpetually allocated towards new acquisitions and profit streams, paying down debt, or investor returns.

Not all businesses justify the reinvestment of profits into their growth initiatives. For example, if an aggregator can acquire new companies at 3-5x LTM EBITDA, reinvesting profits into an existing portfolio company must, at a minimum, exceed a similar return hurdle. This may seem obvious, but it’s a mindset that can be difficult for some acquirers to embrace.

Acquirers lacking a disciplined and data-driven approach may erroneously believe that they know better than the founders or operators they buy from. For example, imprudently reinvesting profits into ineffective product enhancements or new features without considering the opportunity costs–making the acquisition less profitable in the end. Meanwhile, more thoughtful acquirers will execute a post-acquisition playbook that includes synergistic cost reductions, price optimization, and product reinvestment, but only when the data supports such actions.

A proven approach across diverse industries

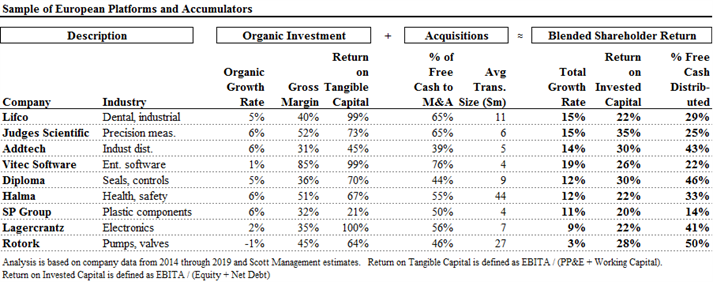

This approach isn’t exclusive to the SaaS space. In fact, the following table highlights a diverse mix of platforms and accumulators that have demonstrated an ability to generate attractive financial returns over time with only modest, if any, organic growth.[ii]

Sample of European Platforms and Accumulators by Scott Management LLC

As evident in this table from Scott Management, the ability of these serial acquirers to generate value does not come, in any significant way, from engineering organic growth. Instead, they apply a careful strategy that includes targeting smaller companies, cultivating relationships with owners making them able to identify targets long before they are available for sale, and, once acquired, providing investment expertise and resources. The specialized nature of the acquired companies can limit organic growth opportunities (organic growth rates for these top performers range from -1% to a high of only 6%), making the deployment of capital in further acquisitions the better option.

SureSwift Capital: Building the better way

At SureSwift Capital, we are keenly aware of the importance of a data-driven approach and implement rigorous processes, such as our Exceptional Operators Framework, to deliver repeatable growth and success. Unlike other aggregators that saw Constellation’s lack of organic growth as an opportunity to fight against and improve on, we saw it as a lesson, supported by data, to learn from. Instead of struggling against the data, we’re doing what we know is proven to work by prioritizing optimal capital allocation over growth for the sake of growth.

Our team at SureSwift Capital also understands that companies that generate outsized returns tend to be those with an intrinsically high return on equity profile. Return on equity is not only driven by a company’s capital allocation but also by other management decisions, such as operational efficiency and strategic decisions, all of which we assess and implement through our Exceptional Operators Framework. This framework optimizes pricing, lowers costs through synergies, generates new businesses and reinvests in products, precisely when the data supports such actions.

The alignment of interests between investors and stewards of capital is also critical for the success of any serial aggregator. SureSwift’s unique monthly distribution model is transparent and ensures our investors are always top of mind in every decision. Every month, our investors receive distributions generated from the profits of our portfolio of companies, allowing investors to track fund performance easily and accurately. We also anchor our management fees to the same metrics that determine payouts to investors, keeping us accountable and disciplined in targeting a 20 percent cash-on-cash annualized return as our minimum hurdle for every new acquisition we make.

Conclusion: the only real mistake is the one from which we learn nothing

With the breadth and depth of data available today, limiting yourself to your own experience is irresponsible. As the competitive landscape continues to evolve, learning from the experience of others, making good use of data, and focusing on proven strategies will often mean the difference between success and failure.

If you’d like to check out more resources with insights all aggregators can benefit from, check out the below:

Books

- The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Successby Will Thorndike

- 100 Baggers: Stocks That Return 100-to-1 and How To Find Themby Christopher Mayer