Decisive Dividend Corporation Proposes Expanded Credit Facility

After the market closed on February 12, 2024, Decisive Dividend (TSXV:DE) announced a proposal to expand its available capital by a substantial 107 million. This indicative move involves the establishment of a new syndicated credit facility that includes two key components.

Indicative, I would suggest, of new accretive acquisitions quite possibly in the works.

The new facility proposes the following:

- Senior secured revolving term loan: a committed $100 million loan that provides flexibility for the corporations financial operations.

- Accordion facility: a $75 million provision that allows for additional borrowing if needed.

I’ve been an admiring shareholder of this company for a while— listening and learning. At one of Sureswift Capital’s meetings about five months ago, our leadership team watched a 56 minute interview dated Aug 16, 2023 with Jeff Schellenberg, the Decisive Dividend CEO and hosted by smallcap discoveries.

Twice.

No fluff, no hype, no burly superlatives, no spin; just the data presented clearly.

The interview covers the DE business model and the companies ambition to grow EBITDA by 25% per year. The data is presented in a meaningful way for shareholders, on a per share basis. Expected growth rates on a per share basis, what each new acquisition means to shareholder profits on a per share basis, etc.

This is a really, really good interview.

But what’s even more interesting is that when a new acquisition is announced the expected per share profit increase has been, in the past, clearly articulated. So, this announcement of a planned increased credit facility, which would foreseeably precede a forthcoming acquisition, is especially interesting.

My shares go into the coffee can.

Shares to hold for the long term are added to the coffee can. Generated using A.I.

Decisive Dividend is very similar to Sureswift Capital Inc. Both companies employ a serial acquisition strategy and both pay monthly distributions (this is rare but powerful, as many people are now seeing). Where we differ is that while SureSwift is focused on acquiring profitable SAAS (software as a service businesses), Decisive Dividend is focused on acquisitions in the manufacturing and industrial space. We are more alike than we are different as it is capital allocation discipline along with operational excellence that will determine success as a serial acquirer.

And, it’s the monthly sharing of profits that makes both stand a fair distance from other serial acquirers.

Presented below is a quick overview of Decisive Dividend

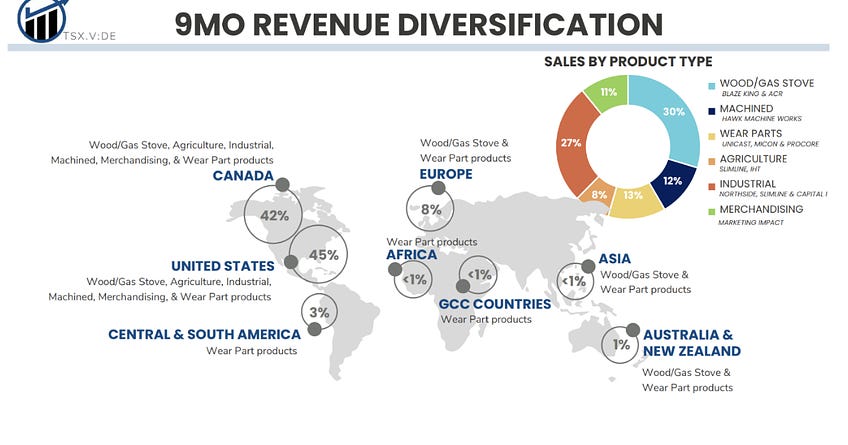

Decisive Dividend Corporation (DE) is a Canadian microcap ($174.44M CAD market cap) based in Kelowna, British Columbia, operating as a global acquirer in the industrial manufacturing and supply sectors1. Though acquisitions have thus far been focused mostly in North America, both the North American and global industrial sectors are fragmented and offer significant potential for acquisition2.

Using a defined acquisition process, DE targets small, cash-flowing manufacturing businesses that meet its acquisition targets and purchases them with a mix of cash (debt) and equity3.

Acquired businesses vary across product specializations, from packaged consumer goods to wood and gas stoves, as well as across targeted sectors, from agriculture to construction4. This generalization helps to diversify the business and protect against the cyclicality that many focused manufacturers are exposed to. Despite the wide range of products and sectors serviced, DE organizes their acquisitions into two broad designations: finished products and components, and further segments their revenues by product type.

Figure 1: Decisive Dividend Corporation. Sales by Geography & Product Type. https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf.

Decisive Dividend differentiates itself from most other serial acquirers by offering monthly dividends to shareholders, its judicious use of debt, and with its long-term outlook. Rather than buying to sell further down the road at a profit, as many private equity companies aim to do, DE acquires businesses to grow and hold over the long haul.

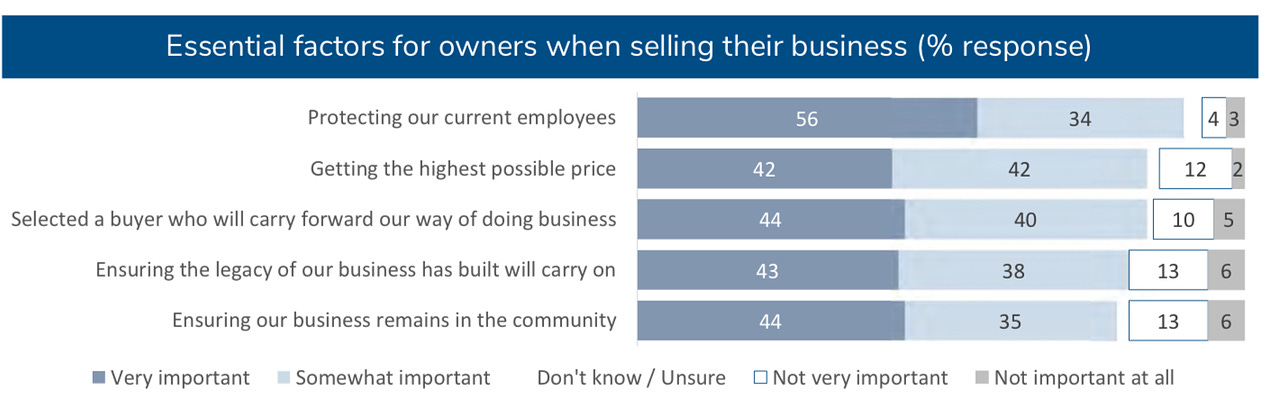

This gives the company a compelling edge over other acquirers in that many business owners feel strongly about their businesses; they have put in time, money, and hard work over many years to build a successful company. As a result, when it comes time to exit or retire, many business owners are interested in selling to someone who can continue the legacy they’ve worked so hard to build5.

As opposed to a “buy and sell” strategy, DE’s priority on long-term ownership and improvement exemplifies what many exiting founders are looking for in a legacy-oriented buyer. For this reason, DE is able to stand out amongst other acquirers and potentially find more attractive acquisition opportunities6.

It’s exactly these legacy-oriented owners that Decisive Dividend is targeting. The company has modelled its business around not only returning maximum value to shareholders over the long term, but also around becoming the stand-out choice among acquisition-based models for business owners looking to make an exit7.

There’s evidence to support the idea that this is a strategic focus for DE. An estimated $2 trillion in assets is expected to become available over the next 10 years, as 76% of business owners plan to exit their businesses over that period8. As more of these owners look to exit their businesses, DE’s pipeline of potential acquisition targets will expand concurrently.

As for factors influencing business owners during the sale process, the majority of owners polled stated that protecting current employees (56%) and maintaining the legacy of the business (44%) took priority over selling at the highest possible price (42%), evidencing the attractiveness of DE’s long-term strategy to potential sellers9.

Figure 2: Decisive Dividend Corporation. Factors Influencing Business Sales. https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf.

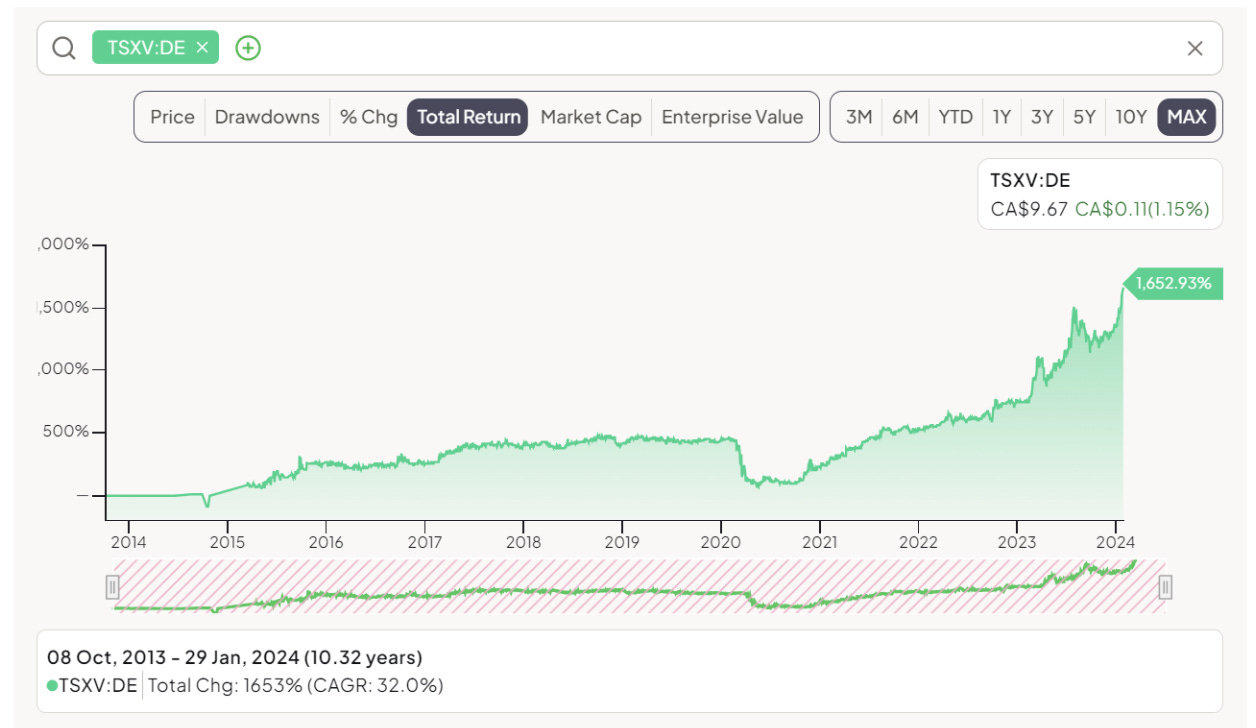

The cumulative effect of DE’s business strategy of growing and holding acquisitions and a stringent acquisition process has led to both interest from owners looking to exit their business as well as significant returns to shareholders since its 2013 IPO, with an annualized total return including dividends of ~32% (as of January 30th, 202410).

Figure 3: Decisive Dividend Corporation – Total Returns. https://finchat.io/company/TSXV-DE/?.

DE’s business model has been central to the company’s success over the last decade and deserves extra examination to analyze not only how it’s been able to achieve these returns but also its future potential and what sets it apart from other acquisition-based models.

Business Model

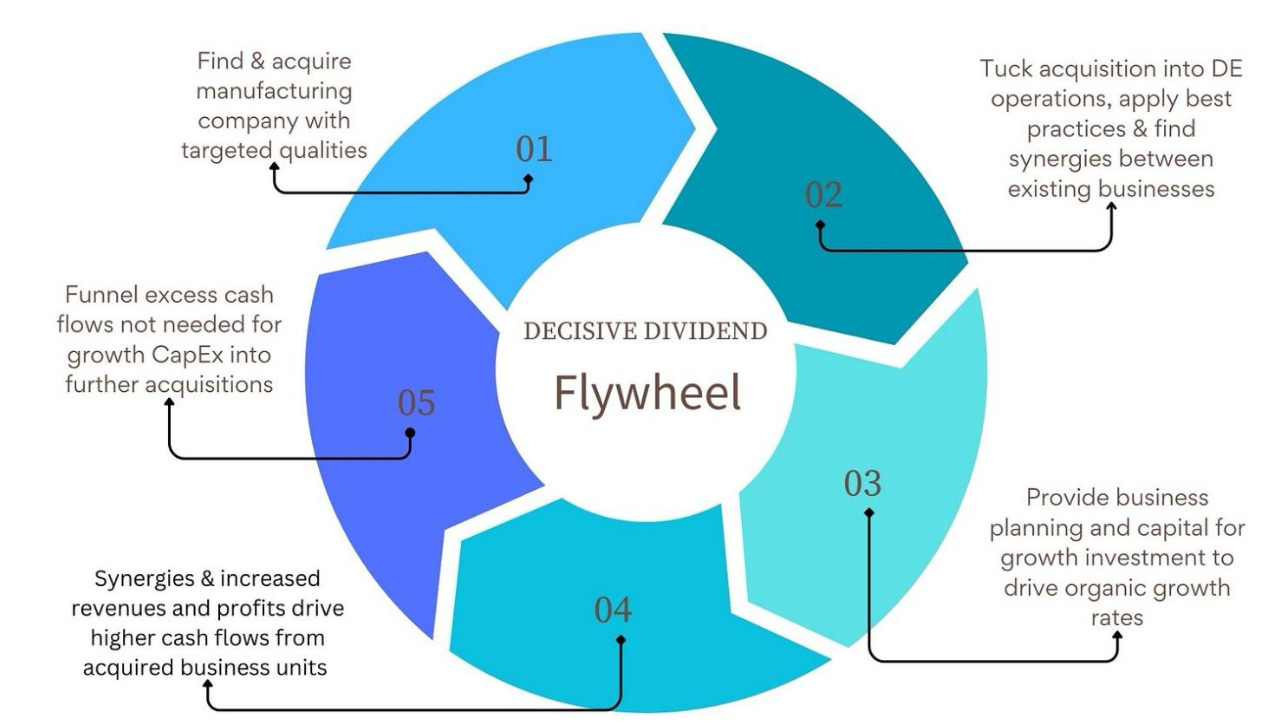

While diversified across various manufacturing sectors and products through its different holdings, the business model for Decisive Dividend Corp. itself is entirely based around its acquisition strategy and the growth flywheel for serial acquirers.

The growth flywheel is central to the business model for acquisition-focused companies, such as DE, while the acquisition process itself serves more as a layer that determines the success of that flywheel.

This model feeds into itself as more acquisitions are made11. With more acquisitions come more cash flows, in turn providing the ammunition to continue acquiring more businesses and further expanding cash flows. With each business acquired, provided acquisitions are made at the right price, DE is able to benefit from economies of scale and increased operational leverage.

Figure 4: Decisive Dividend Corporation – Flywheel for Growth. Data source from https://www.sciencedirect.com/science/article/abs/pii/S0165188917300969.

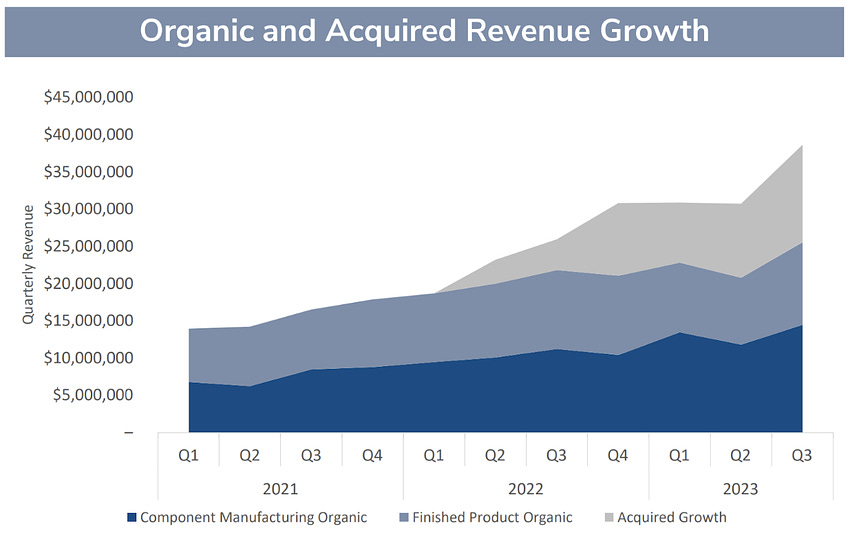

This strategy is bolstered by DE’s focus on holding businesses over the long term and allowing their value to compound, but also by organically growing businesses post-acquisition. This organic growth is especially crucial to DE’s success. By finding synergies between other companies in the portfolio and applying best practices discovered through a history of successful acquisitions and operations, DE is able to significantly expand the topline revenues of acquired businesses12. The strong double-digit organic growth rate (15%) that DE registered in Q3’ 2023 for the five businesses acquired pre-2022 is strong evidence of DE’s ability to deliver on this crucial step in the business model.

Figure 5: Decisive Dividend Corporation – Organic & Acquired Growth. https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf.

By being able to fold acquired businesses under the DE umbrella and recognize accretive value from them quickly, DE benefits from multiple arbitrage that drives down the ‘real’ cost paid for acquisitions13. Meanwhile, cash flows per unit can be improved and quickly put to work funding new acquisitions (or expanded credit lines) to further compound the value of the initial investment.

Hearkening back to the flywheel, this process only expands with scale14. As more businesses are added, there is more potential to drive greater synergies between acquired companies and, in turn, heighten organic growth figures to further expand cash flows.

The business model at the heart of Decisive Dividend Corporation, focused on long-term holding periods and organic growth, is extremely attractive. However, the “buy and build” strategy that DE follows is more easily admired than executed. Most of that difficulty can be attributed to the creation and, crucially, execution of an established and accretive acquisition strategy.

Acquisition Strategy

Anyone with cash or a bank loan can acquire businesses. However, doing so successfully requires a rigid and defined process that targets the right businesses at the right prices and manages them appropriately. Decisive Dividend’s strategy for finding, purchasing, and operating acquisitions exemplifies many of the attributes that have been proven successful by other serial acquirers15:

- Target manufacturing companies with the following attributes:

- Mature and proven businesses with positive cash flows – no early-stage or unproven models/products.

- Up to $25m in enterprise value.

- Future growth opportunities.

- Competitive advantages in targeted sectors or products.

- Buy businesses that meet the criteria at the right prices.

- Defined acquisition price based on EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples – roughly 3-4x, according to Board Director Bruce Campbell16.

- Purchase 100% of the acquired business – no part ownership or conflicting equity interests.

- A minimum 10% of the purchase price is paid using equity, and the remainder is paid with cash.

- Long-term aim for a capital structure comprised of 50% debt, 50% equity to maintain a healthy and investment-grade balance sheet.

- Operate acquired units with a long-term vision.

- Provide capital to make investments and grow.

- Grant access to a wider talent pool, create synergies with other businesses under the Decisive Dividend umbrella, and provide business planning assistance.

- Ensure ‘business-as-usual’ for employees and remaining management while offering equity incentives to ensure alignment with the long-term vision.

- Give acquired businesses autonomy while maintaining branding and identity.

DE’s focus on smaller businesses equal to or less than an enterprise value of $25m is a particularly attractive place to be. Firstly, smaller acquisition targets generally attract less competition, which may otherwise force purchase multiples higher or simply outbid DE during the acquisition process17. Secondly, smaller acquisitions typically face fewer regulatory hurdles in completing buyouts.

Lastly, companies of this size are typically trading at more attractive valuations than their larger peers, offering more potential acquisition targets at DE’s targeted EBITDA multiple and mitigating the downside risk associated with paying higher valuations18.

Figure 6: Visual sourced from Bain & Company. https://www.bain.com/insights/buy-and-build-global-private-equity-report-2019/. Data from PitchBook Data.

While performing due diligence and paying fair price multiples are extremely important to the success of the overall acquisition strategy, DE’s integration of businesses post-acquisition is equally important19. DE’s impressive organic growth rates are driven by granting businesses the capital and talent they need to grow while leaving alone those qualities that drove the acquisition’s success in the first place: brand identity, operational structure, and employee and management teams.

Targeting smaller and more attractively valued deal sizes has worked well for DE thus far, as has its structured acquisition and operation process. Looking forward, DE is focusing on sustained growth into the future by continuing and further refining this process to focus on high-margin products, synergistic potential, and further diversification to protect against cyclicality20.

Acquisitions

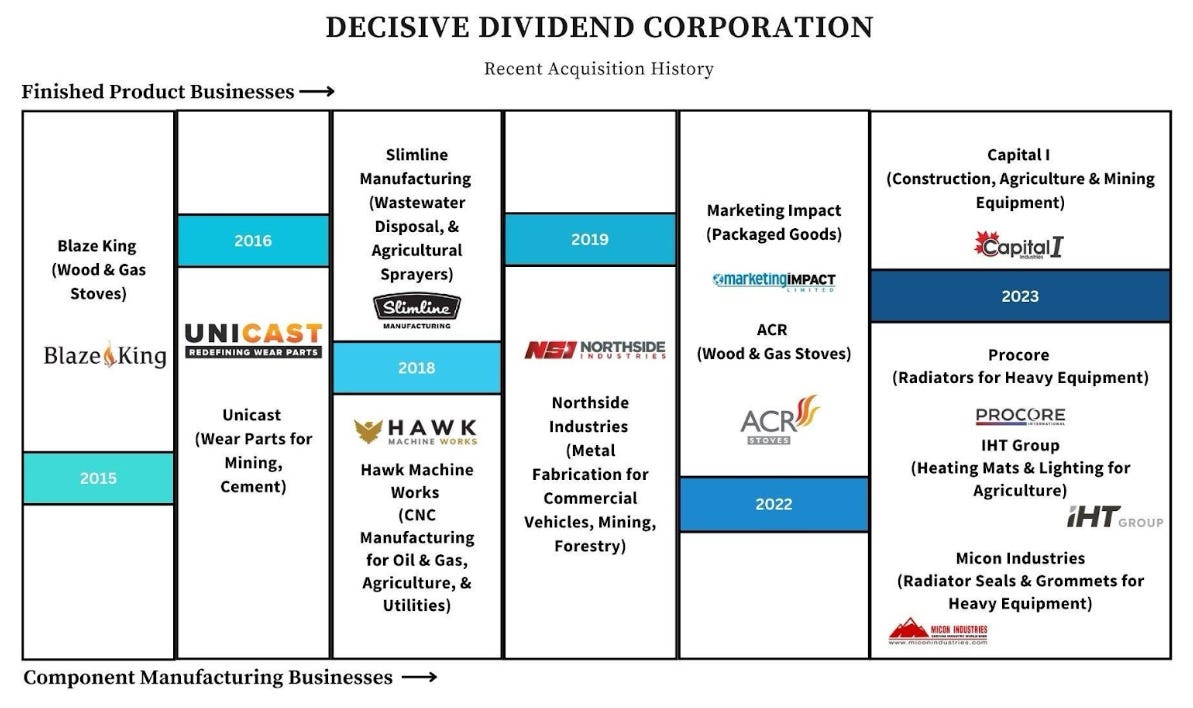

Figure 7: Decisive Dividend Corporation – Acquisition History. Data sourced from https://decisivedividend.com/portfolio/.

Since Decisive Dividend completed its first acquisition in 2015 of Blaze King, which manufactures consumer-ready wood and gas stoves, the company has delivered on its acquisition strategy by tucking in not just more companies but also those that have synergistic attributes with existing companies in the portfolio wherever possible.

For example, Blaze King is able to utilize excess manufacturing capacity, which would otherwise be an inefficient use of assets, to accommodate extra demand for Northside Industries.21 Blaze King has also been able to work with ACR to create new stove products for North American and European markets, the latter of which is benefiting from tailwinds as the invasion of Ukraine by Russia drives energy prices higher in parts of the EU.22

DE’s increased acquisition rate over the last two years supports the effectiveness of the flywheel and the increased growth that scale has allowed it to achieve. Annual spend on acquisitions has increased at a 14% CAGR (compound annual growth rate) from 2015 to December 202323, while the market cap increased from ~$1.2m to $151m over that same period (75.6% CAGR)24.

Not only is the total spend on acquisitions growing with scale, but the number of deals is beginning to ramp up as well. After 5 acquisitions between 2015 and 2021, DE has now completed 6 acquisitions over 2022 and 2023, further evidencing the benefits of economies of scale on DE’s business model25.

Leadership Team

Decisive Dividend Corporation is led by an experienced management team across both mergers and acquisitions (M&A), senior leadership positions, and manufacturing. Headed up by CEO Jeff Schellenberg, the management team has a combined 147+ years of experience26 and more than 25 combined years27 with Decisive Dividend Corp.

Jeff Schellenberg – CEO28

- 15 years of experience in management, operations, and acquisitions.

- Previously Co-CEO and CFO at TerraPro, a leading provider of earthworks services in Canada and recognized among Canada’s Best Managed Companies during Schellenberg’s time there.

- Schellenberg has been with Decisive Dividend Corp. as the CEO for nearly 3 years.

Terry Edwards – COO29

- 30 years of experience in management, legal, and manufacturing.

- Held a position as a VP at CIBC, one of Canada’s largest banks, for 6 years, and afterwards served as COO of Pushor Mitchell, British Colombia’s largest law firm outside Vancouver, for 12 years.

- Served as COO of DE for more than 11 years.

Rick Torriero – CFO30

- 20 years of experience in international finance and accounting.

- Prior to Decisive Dividend, Torriero served as VP of Finance for 12 years at Savanna Energy Services, a company servicing drilling and well operations around the globe.

- CFO for more than 5 years.

Craig Stevenson – VP Manufacturing31

- 25 years of experience in leadership of global operations.

- Previously served in various roles, including senior consultant, general manager, and head of operations, at Philips, a global technology and consumer product brand.

- VP of Manufacturing since August 2023.

Julie Wilson – VP People & Culture32

- 25 years in senior level HR.

- Long history of HR roles at Chandos Construction, Terrapro, Nabors Industries, and CIBC.

- Joined Decisive Dividend 6 months ago in September 2023.

Tyler Senft – AVP Corporate Development and M&A33

- 12 years of experience in finance, investing, and business development.

- Formerly served in finance roles at Scotiabank, BMO Private Banking, and Interior Savings.

- Served as Corporate Development Manager with DE for 3 years before transferring to current role in August 2023.

Josh Widmann – AVP of Accounting34

- 10 years of experience in accounting and management.

- Senior accounting and management roles at Grant Thornton LLP, and a Director of Financial Reporting at Canada Drives prior to joining Decisive Dividend.

- AVP of Accounting since joining the company in February 2023.

Gavin Fretwell – AVP Finance35

- 10 years experience in M&A, due diligence, and capital markets.

- Various finance and equity roles at Trilogy Energy Corp., Pembina Pipelines, and BDC.

- Joined Decisive Dividend in July 2023.

The combined experience of DE’s leadership team and recent expansions of the management team will be crucial to the success of the business model as DE continues to scale and target an increasing number of acquisitions. The diversity of that experience is important too, and the management team’s specializations across the various roles needed to make a serial acquisition model work – M&A, finance, senior management, and experience in manufacturing itself – will also play a huge role in future success.

Management is also putting their money where their mouth is. 10.2% of the company is owned by insiders, helping to align management with shareholders and incentivizing the management team’s continued work towards long-term returns for shareholders36.

Board of Directors37

In addition to an experienced leadership team, Decisive Dividend Corporation’s Board of Directors is comprised of varying backgrounds and long tenures with the company. Headed up by the Chair of the Board and founder and former CEO James Patterson, the Board is split into three committees with different areas of business oversight.

James Patterson, Chair of the Board

- Founder and former CEO of Decisive Dividend.

- Former Managing Partner at Pushor Mitchell and extensive experience providing law counsel services to a variety of industries, with special foci on M&A, corporate financing, and business law.

Jeff Schellenberg, Board Member

- CEO of Decisive Dividend.

Audit Committee

Michael Conway, Director & Chair of the Audit Committee

- President of Stratcon Ventures, member of DE’s board since inception.

- Experience providing management consulting and business improvement on the boards of a diverse array of companies, including finance and manufacturing.

Bruce Campbell, Director

- Founder and portfolio manager at StoneCastle Investment Management.

- Extensive experience in North American corporate finance and investment management.

Robert Louie, Director

- Chief of the Westbank First Nation and Owner at Indigenous World Winery.

- Former experience in law, Indigenous governance, and business ownership, as well as with various board roles.

Governance and Compensation Committee

Tim Pirie, Lead Director & Chair of the G&C Committee

- President & Founder of Canadian Nitrogen Services.

- Founder and VP of several global industrial service companies that were later acquired.

Bruce Campbell, Director

Warren Matheos, Director

- Key Account Manager at Jamieson Laboratories.

- Experience in marketing, management, and business development.

Risk Committee

Peter Jeffrey – Director & Chair of the Risk Committee

- President at PDJ & Associates, a consulting firm.

- Experience in senior management and manufacturing.

Terry Edwards, Director

- COO of Decisive Dividend.

Tim Pirie, Lead Director & Chair of the G&C Committee

Competitive Landscape

Consolidation has become an increasingly popular model over the last number of years38, and the fragmentation of the manufacturing and industrial service sectors has attracted competition from other companies looking to acquire in the space and consolidate the industry39.

Many of these other acquirers are focused on specific industries, such as GFL Environmental40 (~$18bn market cap), which acquires waste management services, or Adentra ($730m market cap), which is working to consolidate the architectural product space41.

However, Decisive Dividend is not alone in targeting the broader manufacturing sector without any particular product specialization. Atlas Holdings is a US based, private equity company that, similar to Decisive Dividend, focuses across a broad array of manufacturing sectors, including several that overlap with DE’s own acquisitions: packaging, component manufacturing, and metal fabrication42. Founded in 2002, Atlas Holdings owns a portfolio of 26 manufacturing and industrial services companies that represents a larger-scale operation with more cash flow potential than DE’s own portfolio of 11 acquisitions. Another similar acquirer is American Industrial Partners, though this company focuses on acquiring mid-cap industrial and manufacturing operations and therefore doesn’t directly compete to acquire the same companies as DE is targeting43.

While the serial acquisition business model has become increasingly popular, DE’s model allows it to stand out against many other acquirers. Firstly, its focus on manufacturing and industrial service operations at enterprise values less than $25m lowers the number of competitors44, as larger firms typically require larger acquisitions to meaningfully move the needle on their own businesses45.

Its generalization across different products and sectors serviced also offers a greater number of opportunities and protection against cyclicality that industry-specific consolidators are exposed to. Lastly, catering to legacy-minded business owners is a distinction among acquisition models that sets it apart from many other companies and private equity firms that may look to simply cash out on acquisitions after a few years.

Growth & Future Outlook

Along with generating exceptional returns for shareholders through both capital appreciation and its 5.2% dividend yield46, the underlying business fundamentals for DE have also expanded significantly, particularly in light of new-share issuance.

Per share data on revenues, adjusted EBITDA, free cash flows (excluding maintenance capital expenditures), and dividends have grown at 28%, 27%, 28%, and 6% compounded annual growth rates, respectively47. Net earnings per share (EPS) grew from $0.09 in Q3’ 2019 to $0.35 per share in Q3’ 2023 (31% CAGR) and 29.6% year-over-year4849.

Figure 8: Decisive Dividend Corporation. Growth in Per Share Metrics. https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf.

Free cash flow figures are an especially significant growth story for DE, as this metric serves as a north star for most serial acquirers as evidence of organic growth in acquired businesses and ammunition for future acquisition potential50.

The impressive growth in top-line revenues and the company’s ability to funnel these to the bottom-line for net earnings expansion evidence DE’s fiscal responsibility, growing scale, and ability to improve acquired business units. Furthermore, the improved per share metrics mitigate the dilution to shareholders that occurs through issuing equity for acquisitions and incentive plans.

Beyond continuing to acquire businesses, DE is also enabling further growth by improving the underlying business fundamentals. The primary focus for this is making growth capital expenditures, with $3m in growth CapEx in the last 2 years to improve production capacity as well as efficiency to improve the margin profile51.

Between experienced and incentivized leadership and a strong business model that will benefit from the growing number of owners exiting their businesses and looking for long-term oriented ownership, DE looks well-poised for the future. This is especially true if the past is any indication; DE has grown its underlying business and per share metrics while generating market-beating returns for shareholders alongside a growing dividend52.

I am personally an enthusiastic long-term owner of Decisive Dividend shares. I hold the opinion that this under-the-radar serial acquirer may be an emerging ‘compounder’ and that if they continue to execute well they’ll attract attention from larger institutional investors. I believe there is significant runway in terms of multiple expansion and boundless acquisitive growth. The per share growth metrics exhibited by Decisive Dividend over the last 5 and 10 years are truly impressive— clearly indicating that their monthly dividend model is a powerful driver of compounding predictable shareholder returns. Few serial acquirers are able to achieve a cumulative annual growth rate (CAGR) of 30% or better over a five or ten year period. This is Constellation Software territory.

It can be very profitable to correctly identify an emerging long-term compounder. But, we will only know with certainty in hindsight.

If you are interested in additional research on how to identify the best-of-the-best serial acquirers, please consider reading this detailed report by REQ Capital:

(This is a 326 page deep dive on sourcing potential compounders that are exclusively focused on the serial acquisition model)

Discalimer: The information provided herein is for educational and informational purposes only. It does not constitute investment, legal accounting, or tax advice. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. Before making any investment decisions, it is crucial to seek advice from an independent financial advisor. Every individual’s financial situation is unique, and what works for one person may not be suitable for another. Additionally, consider your risk tolerance, investment goals and time horizon when evaluating investment opportunities. Remember that all investments carry risks including the potential loss of capital. Past performance is not necessarily indicative of future results. Always conduct thorough research, and do diligence before committing to any investment.

1 https://decisivedividend.com/

2 https://www.precedenceresearch.com/industrial-distribution-market

3 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

4 https://decisivedividend.com/portfolio/

6 https://decisivedividend.com/

7 https://decisivedividend.com/

10 https://finchat.io/company/TSXV-DE/?statement=ratios&category=margins

11 https://www.sciencedirect.com/science/article/abs/pii/S0165188917300969

12 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

13 https://www.bain.com/insights/buy-and-build-global-private-equity-report-2019/

14 https://www.bain.com/insights/buy-and-build-global-private-equity-report-2019/

15 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

16 https://www.bnnbloomberg.ca/video/bruce-campbell-discusses-decisive-dividend~649693

17 https://chiefexecutive.net/ma-investors-moving-lower-middle-market/

18 https://www.bain.com/insights/buy-and-build-global-private-equity-report-2019/

19 https://www.atlassian.com/blog/teamwork/post-merger-integration-tips

20 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

21 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

23 Data sourced from https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

24 https://finchat.io/company/TSXV-DE/

25 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

26 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

27 Sourced from individual LinkedIn profiles (linked in footnotes 9-16)

28 https://www.linkedin.com/in/jeffschellenberg/?originalSubdomain=ca

29 https://www.linkedin.com/in/terry-edwards-68ba7b23/?originalSubdomain=ca

30 https://www.linkedin.com/in/rick-torriero-bb5420159/

31 https://www.linkedin.com/in/craigfstevenson/?originalSubdomain=ca

32 https://www.linkedin.com/in/julie-anne-wilsonhr/

33 https://www.linkedin.com/in/tyler-senft-7a013691/?originalSubdomain=ca

34 https://www.linkedin.com/in/josh-widmann-cpa-ca-2bb40b63/?originalSubdomain=ca

35 https://www.linkedin.com/in/gavin-fretwell-cfa-cpa-cma-5a197638/?originalSubdomain=ca

36 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

37 https://decisivedividend.com/investors/

38 https://www.bain.com/insights/buy-and-build-global-private-equity-report-2019/

39 https://www.precedenceresearch.com/industrial-distribution-market

41 https://adentragroup.com/about_adentra/

42 https://www.atlasholdingsllc.com/about-us/

43 https://americanindustrial.com/about/

44 https://chiefexecutive.net/ma-investors-moving-lower-middle-market/

45 https://www.morningstar.com/articles/378312/berkshires-elephant-gun-needs-big-target

46 https://finchat.io/company/TSXV-DE/

47 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

48 https://decisivedividend.com/spot/wp-content/uploads/Q3-19-DDC-MDA-Final.pdf

49 https://decisivedividend.com/spot/wp-content/uploads/Q3-23-DDC-MDA-Final.pdf

50 https://go.gale.com/ps/i.do?

51 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf