I previously wrote about Decisive Dividend Corporation’s business model and segments, acquisition history and a brief overview of the company and management team. You can read that article below if you want to get a brief understanding of the company, but today’s article will be a deeper dive into Decisive Dividend Corporation (DE).

Continuing on with the deeper dive …

A Continuous, Predictable and thoughtfully Accelerating pace of acquisitions is key for optimal compounding

Decisive Dividend’s (DE) acquisition strategy is detailed in the first dive into the business – this section will instead dive into DE’s overall ability to continue acquiring in the future given debt runway and pipeline opportunities, as well as into each of the individual subsidiaries and some of the tailwinds or headwinds affecting each.

DE has maintained over the last several quarters that their list of opportunities remains strong, with a large pipeline of potential acquisitions in the works that meet DE’s broader acquisition strategy1.

This is despite an increased focus on higher-margin manufacturing businesses that are operating in industry verticals already in DE’s portfolio and modelled largely around recurring revenue product bases2. While this more narrow focus does limit DE’s pipeline somewhat, it also ensures that the company is acquiring higher-quality businesses with consistent and predictable cash flows.

Decisive has made 11 transactions to date between its component manufacturing and finished product business segments3. With a long-term capital structure target of 50% debt & 50% equity for acquisitions, DE sits just within range of that target at 48% debt and 52% equity, a metric that includes the minimum 10% equity paid to business owners selling to DE4.

This balanced capital structure ensures that DE can continue to focus on their acquisition strategy well into the future without over-diluting shareholders or over-leveraging themselves. However, DE’s continued ability to access debt will be an ever-present factor in acquiring more businesses, especially after a heightened acquisition year in 2023 across 4 separate business purchases5.

To that end, DE announced in mid-February 2024 that it has made strides toward ensuring continued access to capital to pursue ever-continuous acquisitive growth, as per their model. DE entered into an agreement for a new credit facility with multiple Canadian banks, a deal that raises its total debt capacity from $68m to $175m (+$107m) at interest rates consistent with existing credit agreements6.

The deal is pending final approval, but if approved, it will give Decisive significant extra firepower to capitalize on growth levers and further its acquisition strategy. DE’s annual spend on acquisitions has grown consistently since its first acquisition in 2015 and this move to ensure continued access to debt will enable that trend to continue7.

With debt secured, the big ticket item for DE is to simply do as it has been doing: consistently making acquisitions in the manufacturing space, balancing the capital structure effectively between debt and equity, and driving organic growth for acquired units in both the component manufacturing and finished product segments.

So, let’s dive into those segments and the businesses in each to understand the different tailwinds & headwinds impacting this business, potential risks, and DE’s overall acquisition and post-acquisition strategies.

Component Manufacturing Segment Unicast – 2016

The Business: Unicast designs and distributes wear parts across the globe and for a variety of industries, including cement and mining8. Headquartered in Canada, Unicast distributes across North America, Central & South America, the Middle East, Africa, and Southeast Asia to deliver on its goal of creating high-quality and long-lasting wear parts9.

Wear parts are pieces of equipment that typically take the majority of the wear and tear and which require regular replacement. This provides Unicast with steady and recurring revenue streams, while high-quality parts help to create sticky relationships by providing customers with efficient operations.

The Deal: The purchase of Unicast closed for $9.4m, structured around 72% equity and 28% debt10. Post-acquisition, DE invested capital into Unicast to support product development and expanded the sales team to take advantage of potential growth in global markets and industry verticals1112. Leadership of Unicast passed over to Mark Watson in 2022; Watson has leadership experience across operations, sales, and corporate strategy13.

The Big Picture: Unicast order volumes are down YoY, due largely to economic uncertainty and geopolitical risk from its global operations14, but that is only part of the story. The business, since Watson took over, has focused on higher margins and less capital- and talent-intensive products15. This has helped the business boost margins while reducing the number of warranty claims made on products, as well as maintaining steady revenue sales despite the lower demand16. They have also initiated online marketing efforts that have delivered impressive ROI and meaningful sales to the business17.

Growth capex for Unicast is currently being centred around expanding distribution capacity in North America to accommodate the expected growth in industrial and infrastructure investment over the coming decades in the region18. These investments, stemming primarily from the hundreds of billions committed through the Inflation Reduction Act (IRA) and Bipartisan Infrastructure Law (BIL)19, will provide Unicast with significant tailwinds over the long term. Given these factors, it seems like a very savvy investment by Unicast’s management and DE to focus on this market in particular.

Hawk Machine Works – 2018

The Business: Operating primarily in central- and western Canada, Hawk Machine Works itself manufactures CNC (Computer Numerical Control) parts, tools, and equipment, but it provides for a wide variety of industries: oil & gas, automotive, electrical & utilities, and agriculture20. This diversification offers Hawk Machine Works (HWM) downside risk mitigation against the cyclicality that many manufacturers are exposed to during downturns in certain industries.

HWM is also very flexible in the solutions it can offer to this wide array of clients. Operating with CNC creation allows HWM to create highly customizable pieces in small or large quantities and sizes. In addition to manufacturing, HWM also offers designing, finishing, assembly, and testing services21.

The Deal: Hawk Machine Works was acquired in a 100% equity deal valued at $11.8m22. It closed in 2018 as the founder looked to fund the next stage of growth for the business. DE’s buy, build and hold strategy was evidently attractive for the founders to capitalize on growth potential. The existing management team stayed in place for the transition for four years until leadership was passed onto Tim Stewart in 2022, who has extensive experience in building and developing businesses23.

The Big Picture: Prior to Tim Stewart’s takeover of the business, HWM’s business was highly concentrated with just a few customers24. However, since 2022, Stewart and the DE team have provided strategic and operational planning to de-risk the business and diversify its revenue streams across a wider portfolio of clients25, helping to provide a 25% growth rate year-over-year26.

Despite the diversity in clients and across industries, HWM’s business is still subject to seasonality. Q1 and Q2 are typically lower demand periods, though the business is still experiencing broader tailwinds due to its presence in Mid-Western Canada, where a growing number of oil rigs, in combination with higher commodity prices, provide a boost to Hawk’s overall business27.

Northside Industries – 2019

The Business: Based out of British Columbia, Canada, Northside Industries (NSI) operates in the fabrication of steel and aluminum parts and equipment. One of the business’ primary products is fabricated fuel and hydraulic tanks for commercial and forestry vehicles28.

The business is not restricted to this, however. NSI also fabricates after-market bumpers for work and semi-vehicles, as well as a range of accessories for its brand of fuel tanks. It also distributes Hydrau-Flo, a valve system designed to be safer and more efficient than traditional valves29.

The Deal: NSI was acquired $11.6m at the minimum equity investment that DE demands from vendors (10%), while the rest of the deal was funded by debt (90%)30. A succession plan had already been established with Mark Burleigh, a former CEO with nearly 20 years of experience who had already taken over the role of President in 2018, prior to the acquisition31. Burleigh remains in place as the President of Northside.

The Big Picture: Northside is an excellent example of how Decisive Dividend is able to drive synergies between existing businesses. Utilizing additional manufacturing capacity, NSI is able to deliver product manufacturing services for Blaze King (another DE subsidiary – more on this business in a moment) to help meet product demand while ensuring efficient use of assets at NSI32.

NSI registered exceptional fiscal performance through 2023, contributing a 10% YoY gross margin improvement for the broader component manufacturing segment33 while scaling its revenues by 55% YoY34. NSI itself also made a move to offshore some manufacturing to a plant with a higher degree of automation and production capacity, and partnered with Unicast’s sales force to unlock different markets with new products that NSI has started producing35. These factors, along with more diversified revenue streams and increased production for Blaze King products, have helped the business deliver solid results.

Procore – 2023

The Business: Procore International Radiators produces high-performing radiators for heavy equipment in the mining, oil & gas, and construction industries36. The quality of Procore radiators, which exceed OEM standards, allows them to last longer and helps to make customers’ operations more efficient and cost-effective37. The product mix includes radiators specifically built for a variety of Caterpillar equipment; as one of the world’s largest and most widely-used heavy-duty equipment manufacturers, this offers Procore a large total addressable market in which to operate38.

Crucial to Procore’s value proposition is its distribution network, which places its parts close to where customers need them39, which is often in rural regions in the case of mining and oil & gas industries. This distribution network allows it to serve customers in Australasia and North & South America from its headquarters in Western Canada40.

The Deal: The acquisition of Procore closed for $4.9m, comprised of 65% equity and 35% debt, in early 202341. The original founder of Procore stepped away not long after the deal was completed and was replaced by Brian McDonald in September 2023.

The Big Picture: Procore exemplifies DE’s focus on moving into higher-margin businesses. Though not a large contributor in terms of top-line revenues, Procore sits in the 60% gross margin range, which is especially attractive for a manufacturer42. It also has plenty of growth opportunities to further increase its profit contribution, namely continuing to expand its portfolio of radiators towards different pieces of Caterpillar machinery and expanding into radiators for other OEMs like Deere43.

If able to deliver on these growth levers and expand top-line contributions, Procore should make a meaningful change in DE’s overall gross margin, which sits significantly below the 60% range at 43%.

Micon Industries – 2023

The Business: Like Procore, Micon Industries focuses on radiators, though it differs slightly in that it manufactures seals and grommets for radiators. Otherwise, however, it serves largely the same industries and geographies. It also provides a similar value proposition to Procore in that it focuses on high quality products with a wide distribution network to reduce costs and wasted time associated with failure of significant wear parts44.

Micon engages in the development and testing of its seals and seal compounds and, like Procore, has a potential growth lever in widening its product portfolio to fit different heavy-duty equipment manufacturers and models45.

The Deal: The deal for Micon rang in at $3.3m and at a 64% equity to 36% debt ratio46. Given the similarities and potential synergies between Micon and Procore, Brian McDonald also took over leadership of Micon and now heads up both business units. Having the two under the same leadership team should allow both businesses to maximize efficiencies.

The Big Picture: Micon has an almost identical “big picture” story to Procore here. The growth levers are the same, as are the underlying business fundamentals – smaller profits but a higher 60% range gross margin47. Finding potential synergies between the two companies, however, could help to drive synergies and organic growth rates that may significantly improve the contributions from both businesses.

Finished Product Segment

Blaze King – 2015

The Business: Operating in the US, Canada, and New Zealand, Blaze King designs and manufactures high-efficiency wood and gas stoves for household heating. Among their products are the #1 and #2 most efficient stoves in North America48. Efficiency is key to Blaze King’s value proposition – its focus on producing wood stoves that allow for lower wood fuel consumption and longer burn times sets it apart from other manufacturers.

While Blaze King’s products were always built for efficiency, it gave the company an additional leg up over competitors when new Environmental Protection Agency regulations, set out in 2020 to manage performance standards for household stoves, were put in place49. Where other manufacturers have gone out of business (45% reduction in wood stove manufacturers due to new regulations50) or had to scramble to meet compliance, Blaze King was able to continue operating business as usual51.

The Deal: Blaze King, Decisive Dividend’s first acquisition, was purchased in 2015 for $6.9m at a 39% equity / 61% debt split52, and serves as a notable example of Decisive’s ability to cater to legacy-oriented buyers by meeting their goals during the acquisition process. Despite not being the highest bidder, DE was still able to complete the deal on the back of its strategy for legacy-oriented sellers53. A succession plan was already in place to bring Alan Murphy into the position of President, a role in which he remains.

Post-acquisition, DE provided capital inflow for Blaze King to expand product offerings and operational efficiency, as well as for further investments in the management team54.

The Big Picture: Blaze King is benefiting from strong demand in the North American market55 which is helping to drive a strong backlog and increased sales since Q4 of 202256. This is normally a very seasonal business, with higher demand in Q3 & Q4 and lower demand during the summer months, though this seasonality abated during unusually high yearly sales over the last two years57.

Q1 & Q2 sales over 2021 and 2022 were able to grow sequentially, foregoing the normal seasonal slump in sales due to tax credits introduced in the US for new energy-efficient biomass stove purchases5859. This higher demand built up a strong backlog for Blaze King products, though a return to normal seasonality in 2023 and higher production capacity have helped Blaze King work through some of the pent up demand60. Q3 was also the first quarter that Northside began taking advantage of unutilized manufacturing capacity to produce Blaze King products, helping to further alleviate the backlog61.

Management also commented on some productivity issues at Blaze King during the Q2 management call, though they also reiterated continued strength in the business through production at Northside and the third-highest volume of orders during these periods since Blaze King was acquired62. This has been partly helped by the acquisition of ACR, which helped Blaze King accelerate its global growth strategy and introduce its high efficiency stoves into the European market63.

Slimline Manufacturing – 2018

The Business: In operation for more than 60 years, Slimline Manufacturing was acquired by DE in 2018. The company produces industrial-level agricultural sprayers and wastewater evaporation units for mining, agriculture, and waste management. The company has global operations that are increasingly expanding into different US states and into South America.

The agricultural side of the business focuses on manufacturing sprayers that can apply treatments efficiently and to a variety of fruit and nut crops. These units spray treatment with precision to provide farmers with fuel, chemical, and water savings that ultimately help to cut costs and ensure efficient operations. The wastewater evaporation segment manufactures and distributes systems built for cheaper, more efficient, and more environmentally friendly wastewater management.

The Deal: Slimline was purchased on a structure comprised of 16% equity and 84% debt, with a final purchase price of $7.0m. The former management team stayed on while a transition plan was put in place, which was completed in 2023 when Daryll Lowry became the new President of Slimline Manufacturing64. Lowry has extensive experience in growing and operating businesses65.

The Big Picture: Slimline was able to post strong contributions under DE over 2023, with growth of 22% being largely driven by a large wastewater evaporator sale for $3.5m66. This is typically a more lumpy side of the business, with the agricultural sprayers providing a more steady revenue stream despite posting lower sales results than in 202267.

However, new president Daryll Lowry is extremely optimistic about the potential impact of a newly designed industrial wastewater unit that’s larger and designed more specifically for tailing ponds (mining operations)68. Tailings ponds are an especially important factor to monitor for mining operations, as mismanagement can lead to significant environmental damage and non-compliance with environmental protection regulations in certain localities. This product may generate significant revenues into the future, though it is also more reliant on historically volatile resource prices.

Marketing Impact – 2022

The Business: Marketing Impact is a vertically integrated designer, manufacturer, and distributor of consumer packaged goods displays and merchandising systems, with over 4000 products to offer clients69. Its customers include large and well-diversified retailers across North America, with a particularly strong foothold in Eastern Canada70.

The rest of Canada and the US offer significant growth potential for Marketing Impact71 as it continues to innovate and work directly with consumers to create branded and custom displays for retail goods and proprietary merchandising systems72.

The Deal: Acquired for $10.0m at a 10% equity and 90% debt structure73, Marketing Impact is another example of DE’s strategic focus on legacy-oriented business sellers and the advantage it gives them over other serial acquirers. The founders of Marketing Impact were looking to transition from the company due to age, but were focused on finding a company, such as DE, that would build upon the existing legacy74.

As of the most recent earnings call reporting results for Q3 ‘23, Marketing Impact had undergone a leadership change75.

The Big Picture: In addition to producing a wide variety of goods, Marketing Impact also holds 15 issued or pending patents to protect their intellectual property76. Despite the protection that patents can provide a business, Marketing Impact has had lower demand YoY for its products, resulting in a 19% decline in revenues YoY77, though management commented that sales were beginning to ramp up in Q4 ‘2378.

Hopefully, this is a business that can begin to stabilize and start to drive more meaningful contributions for DE with new leadership in place that can take advantage of the proprietary systems and potential growth levers.

ACR – 2022

The Business: Founded in the UK and operating there, as well as across Europe, ACR manufactures a wide variety of eco-conscious wood, multifuel, gas, and electric stoves, fireplaces, and even outdoor pizza ovens79. The business is well diversified across consumer discretionary and consumer staple items, offering downside risk mitigation and helping to maximize manufacturing capacity regardless of which products are in demand80.

ACR heating products are designed to burn efficiently and with low carbon emissions. Wood and multifuel stoves are also smoke free, allowing them to be used in smoke exempt areas while still complying with local regulations. ACR owns its own IP and wood stove designs, but outsources production to third-party manufacturers81. This helps it to lower the capital intensity of the business and heighten the margin profile while still maintaining a competitive edge against other stove and heating manufacturers.

The Deal: Decisive Dividend came to the attention of ACR’s founders from the success of the Blaze King acquisition and the job DE had done growing the business post-acquisition while protecting staff and customer relationships82. Not only does this speak to the reputation that DE is beginning to establish in the serial acquisition space, but it also represents a potential growth point for DE as manufacturing businesses may increasingly seek out DE’s model. The deal was completed in 2022 for $8.3m on a 100% equity structure83, and was the first acquisition that DE made into a vertical it already had operations in through Blaze King84.

The Big Picture: Rising energy costs in Europe, centred mostly around geopolitical conflict regarding Russia, one of the world’s top oil exporters, has European households turning to a variety of other heat sources85. This was the primary driver behind a reduced seasonality in the business post-acquisition, where revenues are normally concentrated in the winter months. While this seasonality has picked back up, ACR still stands to benefit from increased attention towards alternative heating sources, and its eco friendly options also improve the likelihood of compliance with potential future environmental regulation changes.

Despite longer-term tailwinds, ACR has experienced slower-than-normal order volume going into Q4 and resulting in higher inventory levels86. This change has largely been driven by discounted pricing on products from competing manufacturers, whereas ACR has not yet chosen to discount items to accommodate the lower demand87.

Capital I – 2023

The Business: Capital I Industries designs and manufactures heavy equipment parts for road maintenance and construction equipment. The business operates in Canada and the US, with Eastern Canada and further penetration into the US being targeted as geographies for growth in the future88.

The business is not limited by geography, and can cater to road maintenance & construction needs across a variety of climates, with mulchers & mower parts, snow blades, and gravel tools being just a part of the arsenal of attachments that Capital I manufactures and distributes. This also allows the business to capitalize on a range of different customers, including heavy equipment dealers, municipalities, and commercial & commodity-focused operations89.

The Deal: After a previous failed attempt at an acquisition, Capital I’s management team was cautious about approaching the sale with Decisive Dividend90. However, potential growth through synergies with Hawk Machine Works and DE’s focus on continuing the business’s legacy under new management ultimately brought the deal to a close. It was acquired for 60% equity and 40% debt, and closed in April 2023 for $11.5m91. Vernon Snidal assumed leadership of Capital I in November 2023 as the culmination of the succession plan92.

The Big Picture: So far undisclosed, the acquisition of Capital I “brought to the table”93 a project that has Capital I, Hawk Machine Works, and Unicast working together. While it will be interesting to see what this project is when/if it’s revealed, the three-way partnership is indicative of the expanded partnerships and synergies that DE is able to create between its different portfolio companies, even across different business segments.

IHT Group – 2023

The Business: Innovative Heating Technologies (IHT) is a refreshing change from DE’s other acquisitions. Though involved in the agriculture industry, similar to other companies in DE’s portfolio, IHT focuses on the animal husbandry side of agriculture with its products for hog (pig) production. Heating mats used for raising young pigs and built to be energy efficient are the company’s primary product, but it also delivers lighting fixtures and is working on delivering cooling products for hog production94.

These products are hugely value additive for farmers, who can use IHT’s products to cut energy costs by as much as 66% while improving animal health & welfare95. Maintaining animal health is crucial to safe and healthy agricultural operations96, while animal welfare has been an increasing trend in agriculture97, giving IHT lots of tailwinds to profit from.

The Deal: DE’s largest acquisition of its 2023 acquisition spree, IHT closed for $15.5m with a payment structure comprised of 41% equity and 59% debt98. The acquisition immediately contributed to DE’s financial results, which speaks to the accretive value of DE’s acquisitions and the company’s broader acquisition targets of profitable and well-established businesses that are able to immediately contribute to DE’s free cash flows. The deal increased DE’s total sales by 12% and adjusted EBITDA per share by 19%99. IHT’s management has agreed to stay on for a transition period of three years to support the next stage of growth in the business100.

The Big Picture: The IHT Group acquisition gives DE another business in the agriculture sector, which provides fairly steady, non-cyclical, and recurring revenue streams. It is also another high-margin manufacturer, reiterating DE’s move to focus its acquisition strategy on businesses that can help to improve DE’s margin profile101.

Agricultural operations are increasingly focusing on efficiency, and IHT’s mats help to provide exactly that, by cutting energy bills significantly. Improved animal health can also lead to better final agricultural products102, creating a win-win for farmers invested in IHT’s products.

That is all of DE’s individual subsidiaries. Through them, DE has exposure to steel, aluminum, and plastic products with very little cyclicality outside of the Blaze King, ACR, Slimline, and HWM acquisitions103104.

Business transitions can be complicated and often require a ramp-up period as new management learns the ins and outs of a business while winning a new team over. For this reason, transitions can be challenging over the short-term. Conversely, initiatives like those seen at Hawk Machine Works and Unicast with new leadership in place also demonstrate the long-term benefits on which DE management and subsequently investors must always be focused.

There’s another, more positive post-acquisition trend that can be seen in many of the individual acquisitions that DE has made; one that points towards the larger picture benefit of Decisive Dividend’s strategy and the effectiveness of its strategic and operational guidance post-acquisition. Many of these businesses were able to see significant improvements after partnering with DE, particularly when new leadership was able to step in.

Post-acquisition, DE has a number of levers it can pull to optimize and grow the businesses:

- Focus on margin improvements

- Control costs

- Expand or modify teams

- Diversify or concentrate product mix

- Diversify revenue streams

- Improving business processes and providing operational strategy

- Find synergies with existing businesses

Synergies are an especially important post-acquisition growth lever. One of the greatest inefficiencies for manufacturing businesses is underutilized assets. Also, production inefficiencies can lower margins in often already margin-constrained businesses. By driving synergies between businesses, however, DE can help to minimize these risks – different businesses can work together towards a common goal and for mutual benefit, ultimately making the whole more valuable than the sum of the parts.

This synergy effect is only likely to continue reaping benefits as DE adds more companies to its portfolio and thereby yielding more synergistic potential. An excellent example is Capital I, whose acquisition brought synergies between 3 separate businesses together. With more companies, there are more possible cross-business opportunities that will continue to drive DE’s organic growth.

Regardless of the initiative taken, Decisive has been able to leverage the best of each of the individual units under its umbrella. Each of these operational moves is assessed to determine whether they meet DE’s 15% hurdle rate for returns on invested capital105 and build off DE’s almost 10 years of experience in providing strategic plans for acquired units. These varied strategies help to drive DE’s strong organic growth figures, determine the company’s ability to sustain them over the long-term, and explain the significant improvement in DE’s underlying business fundamentals.

Business Fundamentals

Balance Sheet Health

Decisive Dividend has delivered some incredible growth across revenues, free cash flows (FCF), earnings, and adjusted EBITDA metrics over the last 5 years106. However, the important thing to monitor with Decisive Dividend is not the overall growth but rather the growth in per share metrics107. Given the business model’s centering around accretive acquisitions and the use of equity in these deals, these metrics give a better glimpse of how Decisive Dividend is generating value for shareholders.

For the Previous Nine Month periods from 2021 → 2022 → 2023108:

- EBITDA per share: $0.55 → $0.77 → $1.07

- 8% CAGR

- Q3 marked the 9th consecutive quarter of record adj. EBITDA levels109

- FCF per share: $0.29 → $0.44 → $0.65

- 9% CAGR

- Net Profit per share: $0.11 → $0.27 → $0.35

- 1% CAGR

DE’s stellar growth in its key per share metrics, including a doubling of the business size in 2023110, demonstrates the performance this business is delivering to shareholders even when accounting for new share issuance. It’s no surprise; DE’s management has remained laser-committed to growing per share figures as a central way to attract investments and reward shareholders, as well as on maintaining disciplined valuations on acquisitions to avoid negatively impacting per share data111. Top-line contributions have also grown across both segments, with strong commodity prices and increased infrastructure spend driving a 37% YoY increase in the component manufacturing segment while the finished product segment grew at a blistering 58% pace YoY112. DE also has plenty of ammunition to continue funding growth capex in its subsidiaries on the heels of a less than 2% maintenance capex required to maintain assets across its portfolio113. This points towards the non-asset intensive nature of the different companies and their potential for future growth.

Another important figure in monitoring DE’s success is the organic growth it has been able to achieve in acquired units by utilizing the growth levers discussed above. DE registered a 15% organic growth rate for the businesses acquired prior to 2022114, an impressive figure that easily exceeds the 8% Q3 mark registered by one of the most well-known serial acquirers, Constellation Software115. It was also a sequential ramp-up from an organic growth figure of 13% in the first half of 2023116.

An over-leveraged balance sheet is another metric to always be mindful of when considering serial acquirers that use significant levels of debt to make acquisitions. Decisive Dividend has done an excellent job of maintaining a healthy balance sheet in this regard through their mix of debt and equity funded acquisitions. The debt-to-adjusted EBITDA figure sits at a very reasonable 1.5x117, offering downside risk mitigation against rising interest rates. It also ensures that DE can continue to fund growth initiatives in its subsidiaries, which will be crucial to driving organic growth rates, growth in per share metrics, and maintaining investor confidence. A strong balance sheet is important so as to ensure that Decisive Dividend always has access to capital, to continually fund future accretive acquisitions.

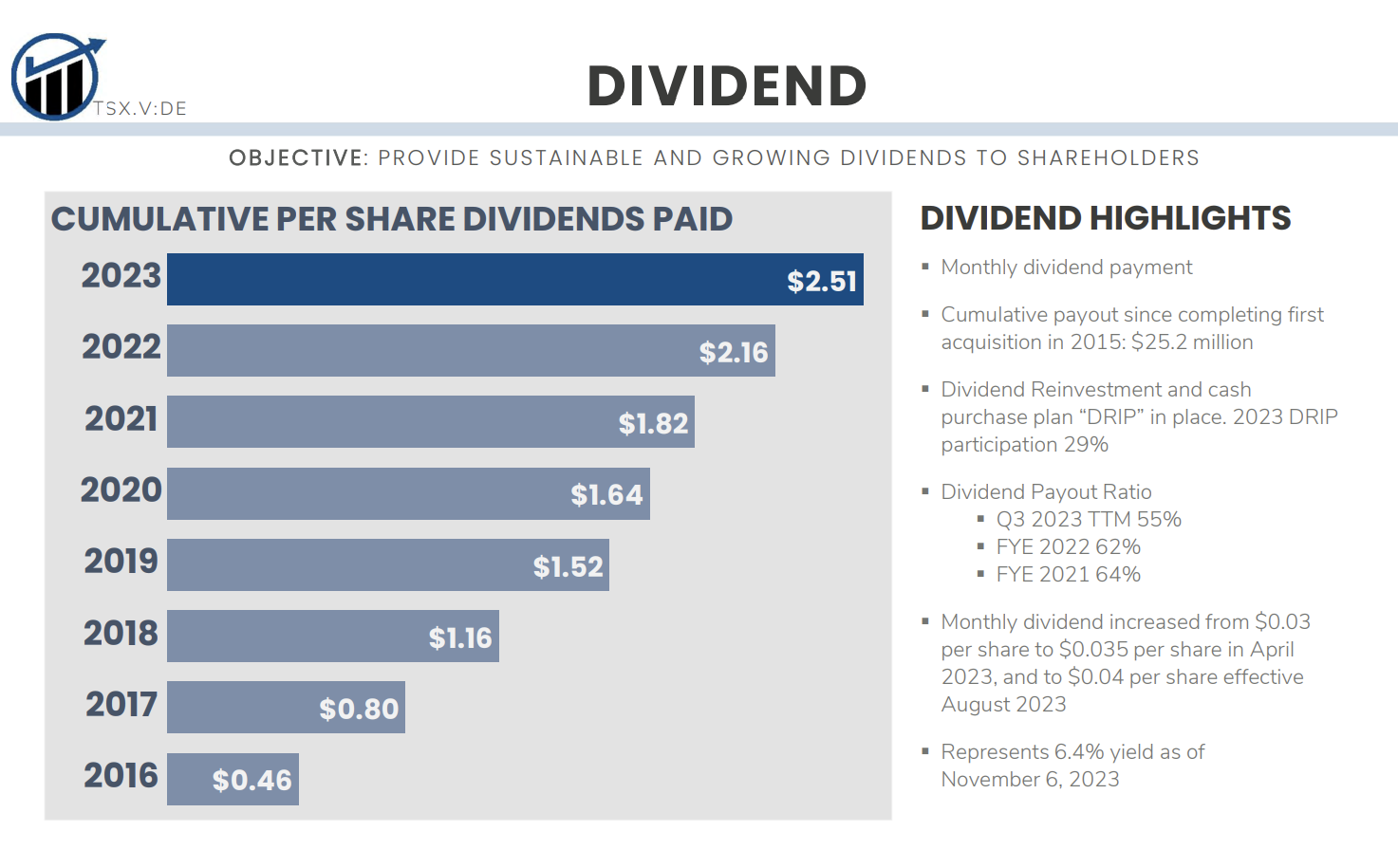

Decisive Dividend focuses on returning free cash flows to shareholders through a strong dividend. Management has been successful with growing the dividends per share at an impressive 27.4% CAGR since 2016 and with attracting further investment through a DRIP (Dividend Reinvestment Plan) that sports a 29% participation rate118. However, it also necessitates an analysis of the dividend payout ratio119 which, if not maintained at a healthy figure, can limit growth capex and restrict cash flows. Management aims to keep the payout ratio around a 60% clip120, a sustainable level that it’s been slowly working towards over the last two years and which should help to ensure DE has sufficient cash flows to support growth initiatives.

Decisive Dividend Corporation – Dividend History. Sourced from https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf.

Commentary from Management

The Smallcap Discoveries service did an excellent interview with Jeff Schellenberg, CEO of Decisive Dividend, where Jeff discusses the business and delves into the granularities of DE’s business model, future outlook, and overall strategy. The video is an absolute gold mine of information straight from the horse’s mouth, one that myself and the rest of the team at Sureswift Capital listened to multiple times and got immense value from. You can watch the video here, but I’ll also be getting into some of my notes and key takeaways from the video below.

One of the key details that Schellenberg provided in the interview was the method of sourcing M&A deals. DE hired a new corporate development manager to help facilitate deal flow, but also utilizes regional & international broker channels to put themselves in front of potential sellers. This is a great method for attracting sellers; once DE has made itself known to sellers, the company’s buy, build, and hold strategy oriented towards legacy owners helps to convince owners to sell to DE. These types of relationships typically take a lot of work and relationship development, but may afterwards pay dividends through DE’s referral network.

DE’s referral network allows the business to leverage their relationships with previous sellers to gain footing with new sellers. The company has also started to go direct to businesses that management is interested in acquiring as an additional method for deal sourcing, one that helps to ensure acquisitions have synergies with existing businesses or add accretive value. The final method of sourcing deals comes from DE’s reputation in the industry, which helped to acquire ACR. Between the various methods of sourcing deals, DE is able to both approach and be approached to complete acquisitions, maximizing the pipeline of potential opportunities.

As far as those opportunities go, Schellenberg also added some colour to the DE acquisition strategy that wasn’t, from what I can tell, included in investor presentations on the company. In addition to revealing the 3.5-5.5x average EBITDA multiple paid for previous acquisitions, he also discussed the acquisition strategy moving forward. For future acquisitions, DE is increasingly moving towards focusing on businesses that have synergies with existing portfolio companies, which will help to drive higher organic growth and continuously improved margins.

Questions surrounding DE’s future targets for acquisition sizes were also brought up in the interview. In a line of questioning that has previously been brought up by analysts during management calls121, Jeff reiterated the focus on targeting smaller companies for their more attractive valuations and because of the company’s built expertise in this particular area of M&A. Interestingly, however, Schellenberg was not totally against the notion of larger deal sizes, quoting, “we’ll more likely get pulled into them than to go out and start hunting elephants because we’ve been successful at some of these smaller deals. I think that the smaller sized deals remain our focus, though I think we have the opportunity at some point to get pulled into some larger stuff, for sure”122.

Despite the potential for opportunistic acquisitions at a larger market cap, the pipeline of smaller acquisition opportunities in the range of $2-5m in EBITDA is still abundant and remains the company’s focus. The pace of DE’s acquisitions in 2023 may have seemed like an anomaly, with an acquisition every 77 days over a period of time, but it speaks to the number of opportunities in DE’s acquisition pipeline. Schellenberg’s comments on this pace should give investors a lot of optimism about its sustainability. While 4 acquisitions in a year (2023) may not be a regular occurrence, management is targeting 1/4 of the previous year’s EBITDA through acquisitions every year as a sustainable pace. If achievable, this pace would allow DE to ramp up per share metrics and the growth of the overall business rapidly and impressively compounding over time.

To ensure this rate of acquisition is achievable, DE has grown its corporate team to handle the increased inflow of M&A opportunities, perform appropriate due diligence on existing and potential acquisitions, and identify chances for creating synergies. Expanding the team will ensure that future acquisitions continue to be timely, strategic and value accretive.

In addition to comments on the future acquisition strategy, DE also expanded on the transition period post-acquisition. Schellenberg revealed that, post-acquisition, acquired businesses are added to existing insurance, benefits, and IT systems to reduce costs and take advantage of the scale of DE’s business while providing additional improvements to acquired businesses and employees. Previous management, meanwhile, is required to maintain a 3-year vesting period with shares acquired during the sale process, with the opportunity to sell 1/3 of the position each year. This helps to ensure aligned incentives over the transition period.

Another big part of the transition is the knowledge transfer from existing to new business leaders, helped along by DE’s goal to keep existing management teams on for a period of time. In the case of IHT, DE’s latest acquisition, the management team agreed to stay on for another three years to support the growth trajectory of the business. Another crucial part of the transition is re-orienting the business towards growth and transitioning away from the ‘traditional’ way of doing things under new management. After previous leaders step away, newly instated leaders often need to rejig how the company was operated to build new avenues for growth or improvement.

A particular note of confidence for both DE’s overall strategy and for investors is Schellenberg’s comments during the interview on increased institutional interest. Waratah Capital Advisors, DE’s largest shareholder with a 15% ownership stake, helped to significantly increase the level of interest from institutional investors due to its reputation in the capital markets. This company also helped to secure the purchase of ACR and entered into an investor rights agreement as part of this deal to maintain a 15% ownership level. Waratah’s interest in the company surely helped, to some degree, to secure DE’s placement as a TSX Venture Top 50 firm, attracting research coverage and attention from investment banks.

Wrap Up Thoughts

Given the various long-term tailwinds for DE’s individual subsidiaries and management’s ability to find synergies and maximize the growth & margin potential for each unit, even despite short-term challenges of management transitions, DE is well poised for continued growth. As the number of portfolio companies continues to grow, boosted by DE’s various deal sourcing methods, synergies may become apparent between a wider number of companies. This actually gives DE the chance to expand on the returns it has provided to shareholders over the last decade and continue improving business fundamentals as it scales.

DE’s balance sheet provides even further optimism for the business. The business has doubled twice since 2021 based on EBITDA figures123. Management is clearly oriented towards growing per share growth metrics so as to provide compelling returns to shareholders even while accounting for balancing the issuance of new shares and increased debt. Schellenberg and co. are also growing the dividend sustainably while responsibly managing the dividend payout ratio so as not to limit growth capex. Finally, DE’s leverage ratio is kept at a fiscally responsible level, while expanded access to debt facilities will help DE to continue making acquisitions into the future.

All told, DE has positioned itself well to become a leading acquirer in the manufacturing space; it’s built up a reputation in the industry that allows it to take advantage of referral networks and companies approaching DE to be acquired. Its performance has also attracted increased institutional interest, which can lead to higher valuations on the business but also provides significant equity backing that enables further acquisitions. Between all of these factors, the pace and value of DE’s acquisitions through 2023 seems to be perpetually repeatable. DE looks to be well-positioned for a long growth runway into the future.

Perpetual repeatability really sums up the latent compoundable-value of a finely tuned serial acquirer.

Decisive dividend has such a model.

As with any really great compounder— they will sometimes seem richly-valued in the short term, but be completely underestimated in the long term.

The potential is there to be a multi-bagger but maybe, just maybe a 100-bagger, time will tell.

Disclaimer: The information provided herein is for educational and informational purposes only. It does not constitute investment, legal, accounting or tax advice. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. Before making any investment decisions, it is crucial to seek advice from an independent financial advisor. Every individual’s financial situation is unique, and what works for one person may not be suitable for another. Additionally, consider your risk tolerance, investment goals and time horizon when evaluating investment opportunities. Remember that all investments carry risks including the potential loss of capital. Past performance is not necessarily indicative of future results. Always conduct thorough research, and do your own due diligence before committing to any investment.

1 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

2 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

3 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

4 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

5 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

6 https://www.investorx.ca/search?FreeSearch=decisive+dividend

7 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

8 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

9 https://decisivedividend.com/portfolio/

10 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

11 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

12 https://decisivedividend.com/spot/wp-content/uploads/DDC-Case-Studies-2023.pdf

13 https://www.linkedin.com/in/markrobertwatson/?originalSubdomain=ca

14 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

15 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

16 https://www.investorx.ca/search?FreeSearch=DECISIVE+DIVIDEND+CORPORATION

17 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

18 https://decisivedividend.com/spot/wp-content/uploads/Q2-2023-Conference-Call-Transcript.pdf

20 https://decisivedividend.com/portfolio/

21 https://decisivedividend.com/portfolio/

22 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

23 https://www.linkedin.com/in/timstewart82/?originalSubdomain=ca

24 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

25 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

26 https://www.investorx.ca/search?FreeSearch=DECISIVE+DIVIDEND+CORPORATION

27 https://decisivedividend.com/spot/wp-content/uploads/Q2-2023-Conference-Call-Transcript.pdf

28 https://decisivedividend.com/portfolio/

29 https://decisivedividend.com/portfolio/

30 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

31 https://www.linkedin.com/in/mark-burleigh-58a14829/?originalSubdomain=ca

32 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

33 https://decisivedividend.com/spot/wp-content/uploads/Q2-2023-Conference-Call-Transcript.pdf

34 https://www.investorx.ca/search?FreeSearch=DECISIVE+DIVIDEND+CORPORATION

35 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

36 https://decisivedividend.com/portfolio/

37 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

38 https://decisivedividend.com/portfolio/

39 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

40 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

41 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

42 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

43 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

44 https://decisivedividend.com/portfolio/

45 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

46 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

47 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

48 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

49 https://www.epa.gov/burnwise/epa-certified-wood-stoves

50 https://www.investorx.ca/search?FreeSearch=DECISIVE+DIVIDEND+CORPORATION

51 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

52 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

53 https://decisivedividend.com/spot/wp-content/uploads/DDC-Case-Studies-2023.pdf

54 https://decisivedividend.com/spot/wp-content/uploads/DDC-Case-Studies-2023.pdf

55 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

56 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

57 https://decisivedividend.com/spot/wp-content/uploads/Q2-2023-Conference-Call-Transcript.pdf

58 https://decisivedividend.com/spot/wp-content/uploads/Q2-2023-Conference-Call-Transcript.pdf

59 https://www.blazeking.com/information/view-current-rebates/

60 https://decisivedividend.com/spot/wp-content/uploads/Q2-2023-Conference-Call-Transcript.pdf

61 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

62 https://decisivedividend.com/spot/wp-content/uploads/Q2-2023-Conference-Call-Transcript.pdf

63 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

64 https://decisivedividend.com/spot/wp-content/uploads/DDC-Case-Studies-2023.pdf

65 https://www.linkedin.com/in/daryll-lowry-0791b44a/?originalSubdomain=ca

66 https://www.investorx.ca/search?FreeSearch=DECISIVE+DIVIDEND+CORPORATION

67 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

68 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

69 https://decisivedividend.com/portfolio/

70 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

71 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

72 https://decisivedividend.com/spot/wp-content/uploads/DDC-Case-Studies-2023.pdf

73 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

74 https://decisivedividend.com/spot/wp-content/uploads/DDC-Case-Studies-2023.pdf

75 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

76 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

77 https://www.investorx.ca/search?FreeSearch=DECISIVE+DIVIDEND+CORPORATION

78 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

79 https://decisivedividend.com/portfolio/

80 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

81 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

82 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

83 https://decisivedividend.com/spot/wp-content/uploads/DDC-Case-Studies-2023.pdf

84 https://www.investorx.ca/search?FreeSearch=DECISIVE+DIVIDEND+CORPORATION

85 https://decisivedividend.com/spot/wp-content/uploads/Q2-2023-Conference-Call-Transcript.pdf

86 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

87 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

88 https://decisivedividend.com/portfolio/

89 https://decisivedividend.com/portfolio/

90 https://decisivedividend.com/spot/wp-content/uploads/DDC-Case-Studies-2023.pdf

91 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

92 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

93 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

95 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

96 https://agriculture.ec.europa.eu/system/files/2023-05/factsheet-agriresearch-animal-health_en.pdf

98 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

99 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

100 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

101 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

102 https://agriculture.ec.europa.eu/system/files/2023-05/factsheet-agriresearch-animal-health_en.pdf

103 https://www.investorx.ca/search?FreeSearch=DECISIVE+DIVIDEND+CORPORATION

104 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

105 https://www.investorx.ca/search?FreeSearch=DECISIVE+DIVIDEND+CORPORATION

106 https://finchat.io/company/TSXV-DE/

107 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

108 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

109 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

110 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

111 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

112 https://www.investorx.ca/search?FreeSearch=DECISIVE+DIVIDEND+CORPORATION

113 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

114 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

115 https://finance.yahoo.com/news/constellation-software-inc-announces-results-220100803.html

116 https://decisivedividend.com/spot/wp-content/uploads/Q2-2023-Conference-Call-Transcript.pdf

117 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf.

118 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

119 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

120 https://decisivedividend.com/spot/wp-content/uploads/Nov-2023-Investor-Presentation.pdf

121 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf

122 Small Cap Discoveries – Decisive Dividend (TSX.V: DE) Interview with CEO Jeff Schellenberg.

123 https://decisivedividend.com/spot/wp-content/uploads/Q3-2023-Conference-Call-Transcript.pdf